Smart Contracts' immutability , a judicial guarantee of globalized monetary freedom

- latinlawyer

- Jan 3

- 5 min read

Published in Legal Today on 3.01.2025

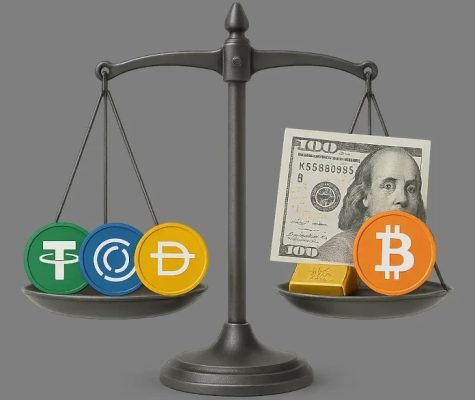

The legal protection of a currency has two sides, that of the issuing power or legal tender and that of its value imposed by the government. Cryptocurrencies, on the other hand, attract us because of the free fluctuation of their value with the guarantee of their transactional immutability. This immutability has disruptively revolutionized monetary law to the point of questioning its existence.

On November 26, the Texas Court of Appeals (5th Circuit) decided in the case “Tornado Cash” between Joseph Van Loon and others against the Foreign Assets Office of the US Department of the Treasury, that smart contracts are neither services nor interests (or assets) of a foreign financial entity that can be subject to the regulatory control of the International Emergency Economic Powers Act (IEEPA).

A week later, President Trump chose Paul Atkins, a strong advocate of cryptocurrencies during his previous tenure at the SEC from 2002 to 2008, to head the Securities and Exchange Commission (SEC).

This ruling and the appointment of the SEC chair promise regulatory innovation in the capital markets with greater recognition and participation of digital currencies. Why are cryptocurrency transactions so relevant to global finance?

Aristotle's monetary illusion

When the man imposed his diet on the pack donkey, he gave him a reward for his effort and accustomed him to receive his food comfortably in front of a vegetarian restaurant. If he pulled the cart, he received his carrot directly prepared for him without having to get the soothing grass to chew on. Thus, the donkey and the man “gave each other” a simplified way to get the cart moving.

With a certain philosophical innocence, Aristotle referred to money as something that men “gave to each other” because of its easy handling, like gold, silver or iron “previously stamped” by weight and size. He did not give any other names in this relation.

Just as the donkey is deluded by saving his vegan food, man works to dream of receiving a coin that will respect its value over time. Both aspire to be paid for something that seems stable but in reality is not. Because they are payments that lack a contractual nature as Aristotle thought (“between themselves”), but rather represent illusions of a stable exchange and a free or neutral simplification, but which have actually been imposed by some regulator or government with the power to alter that value equation over time. Worse still, the regulator has created them to spend on their account just by offering to simplify those relationships.

Immutable smart contracts are tools

The case of Tornado Cash's open source software created to record anonymous cryptocurrency transactions, reverses the regulatory and sanctioning power of the OFAC (Office of Foreign Assets Control) by reviewing the legal nature of digital asset transfers. Smart contracts are not contracts, but tools, we would say that they are just “smart” .

Accused of allowing the laundering of virtual currencies by hackers linked to the governments of North Korea and Russia, the Tornado Cash software platform was blocked by the OFAC, including the operation of its smart contracts, created with open source and which operate its transactions ensuring privacy (anonymity of operations) and functional immutability (independence and uncontrollability, even by its users). Faced with the blockage confirmed in court, they appealed.

a) The appeal decided that in general:

The blockchain functions as a public, permanent, decentralized and free ledger of transactions between a network of independent computers;

Cryptocurrencies are held in wallets with public (addresses) and private (keys) identifiers;

Each transaction is posted on the blockchain showing the addresses;

Addresses are theoretically pseudonyms and although their identification is not impossible, users prefer anonymity;

As in the case of Ether, wallets have external accounts and for smart contracts ;

To operate transactions, the user moves from his external account to the smart contract account, paying a “gas fee” to verifiers;

A smart contract is software uploaded to the blockchain to automatically execute an operation such as transferring ownership of a digital asset between addresses;

b) And in particular on smart contracts :

Smart contracts have two legal forms: mutable and immutable. Mutable contracts are managed by an operator and can be altered. Immutable contracts cannot be changed or removed from the blockchain.

Immutable smart contracts , in this case those of Torndo Cash, do not constitute services or assets of the platform, but are tools for the execution of a service. They cannot be reached by the IEEPA or supervised by OFAC.

While the IEEPA enables the president to block “any property or contract or service or interest” of a foreign entity, it has not specifically defined those terms for its application.

Because they are not appropriable or controllable, they do not constitute property, service or interest, without copyrights, so as to be included in the OFAC regulatory definition.

Which, in particular, are not contracts because they operate as types of unilateral codes used as tools to provide a service, without constituting them per se.

That in extremis , mutable smart contracts can facilitate the creation of a contract but they are not contracts in themselves because the operator (third party) uses the smart contract to transfer the cryptocurrency, fulfilling a different contract between users.

Immutable smart contracts are not even unilateral contracts because they cannot be revoked by the offeror. They operate automatically without any possibility of revocation.

Transactional immutability guarantees monetary freedom

According to the ruling, smart contracts could result, as Aristotle put it, from “something that men gave to each other” to simplify transactions.

The donkey would receive his vegan plate, the man his coin, both comfortably operating a coded tool with no possibility of being altered.

The immutability of these transactions eliminates any third-party intervention, be it the regulator or currency operator, eradicating the hidden tax that is applied every time it alters the equation between the parties in exchange for an insignificant “gas fee . ”

Immutable smart contracts represent Aristotle's illusion made reality, thanks to technology and open source , which eliminate the inflationary pressure of governments and ensure constant freedom of exchange, in this case, of cryptocurrencies.

In this sense, the new US government has observed that these tools ( smart contracts ) can assist in containing public spending, demagogic inflation and monetary law (even community law), which enrich an intermediary without generating greater wealth.

Regarding money, man already distrusts both sides, because the issuing power represents its main user and consequently, the spender; because the minted value does not promise the immutability of transactions but on the contrary, defrauds him with its inflationary numbers.

Comments